In an era where 63% of Americans can't pass a basic financial literacy test according to FINRA's 2023 National Financial Capability Study, the strategic role of government in personal financial education has never been more critical. The Federal Reserve's data showing that 40% of adults struggle with a $400 emergency expense reveals systemic vulnerabilities that Public Finance initiatives aim to address through structured National Financial Literacy Programs. This examination explores how Policy Regulation and federal funding mechanisms create comprehensive financial education ecosystems.

The U.S. Treasury's Financial Literacy and Education Commission (FLEC), established under the 2003 Financial Literacy and Education Improvement Act, exemplifies Public Finance in action. With representation from 24 federal agencies, FLEC coordinates initiatives like MyMoney.gov - receiving $15.2 million in 2023 congressional appropriations (U.S. Treasury FY2023 Budget Report). This platform serves 3.4 million annual visitors with free resources on debt management, retirement planning, and consumer protection.

The Money as You Grow program demonstrates targeted Public Finance deployment, reaching 78% of public school districts through partnerships with the Department of Education. A 2022 Urban Institute study found participants showed 31% higher savings rates than control groups, validating the ROI of early financial education investments.

Congressional Budget Office data reveals a 197% increase in federal financial literacy funding (2010-2023), correlating with measurable outcomes. States receiving FLEC grants saw 22% higher financial capability scores (FINRA 2023 State-by-State Report). The correlation between Public Finance allocations and improved financial behaviors underscores government's unique capacity to scale education initiatives.

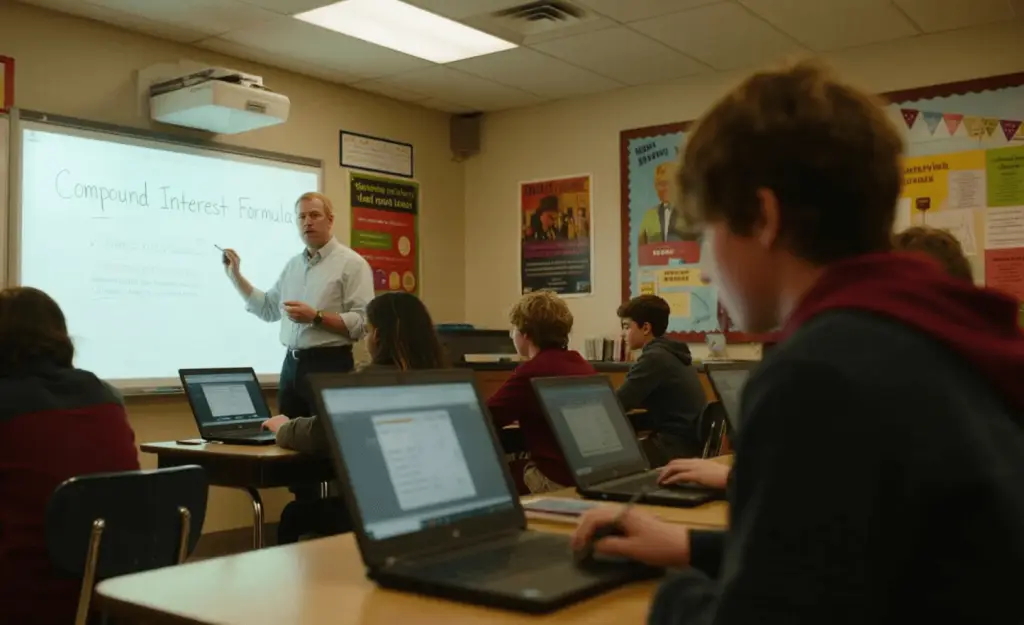

The Jump$tart Coalition's National Standards for Financial Literacy demonstrate Policy Regulation's transformative potential. Adopted by 37 states, these standards have increased high school financial course completion rates by 58% since 2015 (Council for Economic Education Survey). Virginia's 2021 mandate requiring personal finance coursework resulted in 43% fewer students taking high-interest payday loans within two years (Virginia Department of Education).

From the 1994 Family and Consumer Sciences Education Act to the 2019 Economic Growth Act, Policy Regulation has progressively expanded financial education mandates. Currently, 25 states require standalone personal finance courses - a 400% increase since 2000 (Next Gen Personal Finance). The 2003 Financial Literacy Act's creation of FLEC represents a watershed moment in federal coordination of National Financial Literacy Programs.

The CFPB's digital tools exemplify Public Finance driving innovation, with their Paycheck Calculator used by 1.2 million Americans monthly. SBA's mobile financial literacy modules achieved 89% completion rates among small business owners - 27% higher than in-person workshops (SBA 2023 Annual Report). This demonstrates how Policy Regulation can adapt to changing learning preferences.

The Department of Education's AI initiatives show promise, with chatbot users demonstrating 34% better retention than traditional methods (ED Tech Office Pilot Data). Public Finance enables these innovations while Policy Regulation ensures ethical implementation - a balance critical for maintaining public trust in National Financial Literacy Programs.

As financial products grow increasingly complex, the need for robust Public Finance interventions intensifies. Emerging Policy Regulation must address cryptocurrency literacy (held by 16% of Americans per Pew Research) and AI-driven financial services. The government's unique position to coordinate cross-sector National Financial Literacy Programs will prove vital in navigating these challenges.

Disclaimer: The information provided about The Role of Government in Personal Financial Education is for general knowledge only and does not constitute professional financial advice. Readers should consult qualified professionals before making financial decisions. The author and publisher disclaim liability for any actions taken based on this content.

Thompson

|

2025.08.05