In today's competitive real estate market where median home prices in cities like San Francisco exceed $1.5 million, conventional mortgages often fall short. This comprehensive guide reveals exactly what it takes to secure a jumbo loan in 2024, including the latest FHFA loan limit thresholds and proven strategies to meet strict creditworthiness standards. Whether you're buying a luxury property or investing in high-cost markets, understanding these requirements could mean the difference between approval and rejection.

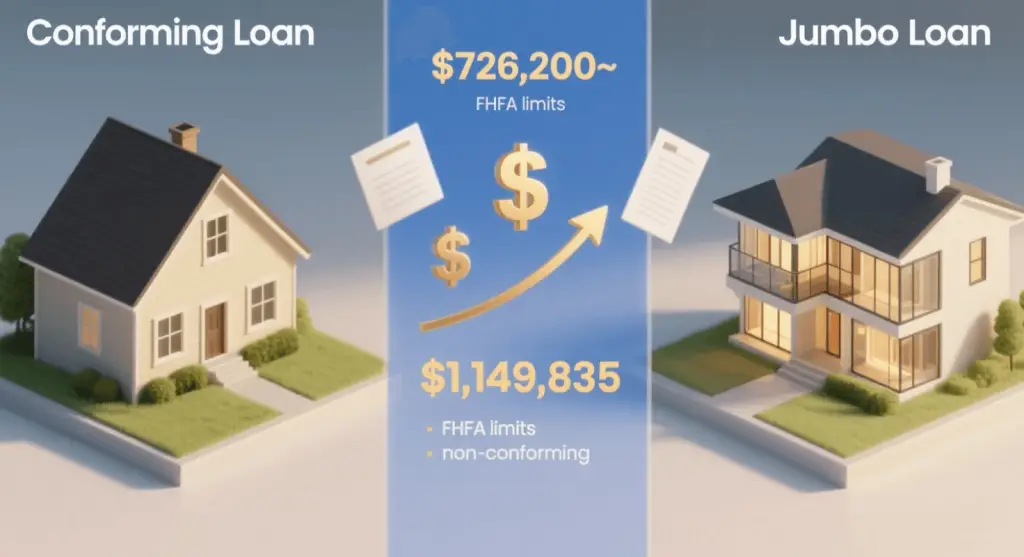

Unlike conforming loans which follow FHFA limits ($766,550 in most areas for 2024), jumbo loans exceed these thresholds and aren't backed by Fannie Mae or Freddie Mac. According to Mortgage Bankers Association data, jumbo loans now represent 23% of all mortgage applications in high-cost markets, with interest rates averaging 0.25-0.5% higher than conventional loans due to increased lender risk.

The Federal Housing Finance Agency's 2024 update shows significant variations in jumbo loan thresholds:

While conventional loans may accept FICO scores as low as 620, qualifying for a jumbo loan in 2024 typically requires:

Jumbo loan applicants must provide extensive financial documentation proving stability:

Compare these key factors when selecting a jumbo loan provider:

| Lender Type | Avg. Rate | Down Payment | Time to Close |

|---|---|---|---|

| Big Banks | 6.75% | 20-30% | 45-60 days |

| Credit Unions | 6.50% | 15-20% | 30-45 days |

| Online Lenders | 6.25% | 10-15% | 21-30 days |

Jumbo loan underwriting involves additional scrutiny:

Q: Can I get a jumbo loan with 10% down?

A: Some lenders offer 10% down options but typically require PMI and higher interest rates. Most recommend 20%+.

Q: Are jumbo loan rates always higher?

A: Not necessarily. For well-qualified borrowers (760+ credit, 30%+ down), rates can be competitive with conforming loans.

Disclaimer: This content is for informational purposes only and not professional financial advice. Consult licensed mortgage professionals before making decisions.

Taylor Smith

|

2025.08.06