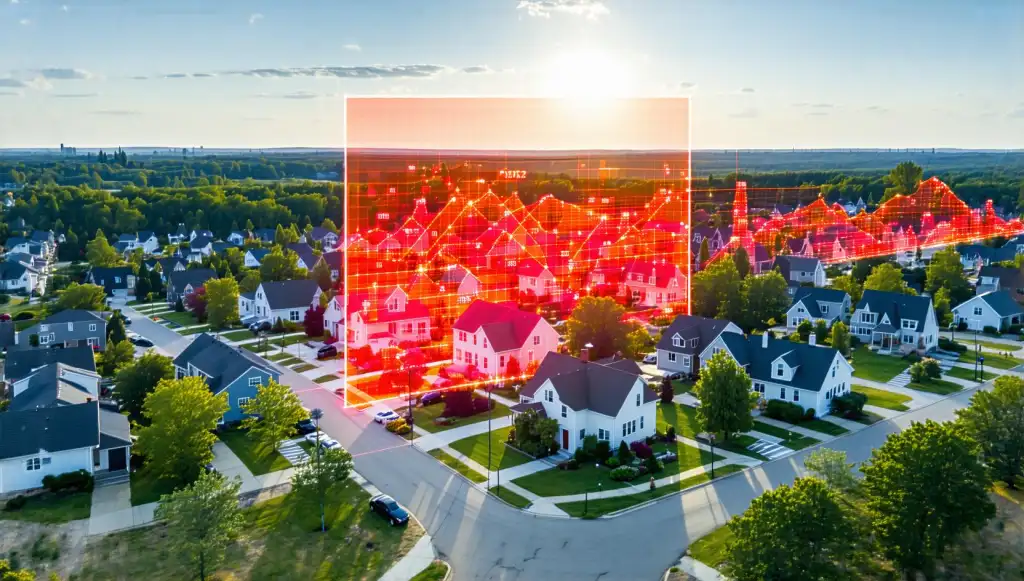

When calculating monthly housing costs, most homebuyers focus on mortgage rates while overlooking how significantly property taxes influence their payments. The property taxes impact on mortgage payments often surprises buyers who didn't account for these mandatory contributions to local governments. This comprehensive guide examines how tax assessment methods and escrow accounts work together to shape your actual homeownership costs.

Consider Sarah, a first-time homebuyer in Austin, Texas. Her $300,000 home comes with annual property taxes of $6,300 (2.1% of home value), adding $525 to her monthly payment. This represents 28% of her total mortgage payment - a substantial portion many buyers underestimate when budgeting. The property taxes impact on mortgage payments varies by location but consistently affects affordability across all markets.

Municipalities use three primary tax assessment methods to calculate obligations:

According to the Lincoln Institute of Land Policy, effective property taxes rates range from 0.32% in Hawaii to 2.13% in New Jersey. These geographical disparities directly influence the property taxes impact on mortgage payments nationwide.

Lenders incorporate estimated property taxes through a proration system. Using the previous year's tax bill or current tax assessment methods, they divide the annual amount into twelve equal installments. This estimation process creates potential discrepancies - when actual taxes exceed projections, borrowers face unexpected payment increases mid-loan term.

Escrow accounts serve as tax payment reservoirs, with lenders collecting 1/12th of projected annual property taxes each month. When tax bills arrive, lenders disburse funds directly to municipalities. The Consumer Financial Protection Bureau reports that 80% of conventional loans include escrow accounts, creating both payment convenience and potential budgeting challenges when tax rates fluctuate.

The Thompson family learned about property taxes impact on mortgage payments the hard way when their Denver home's reassessment increased values by 40% post-renovation. Their monthly payment jumped $327, forcing them to refinance. Such scenarios demonstrate why understanding local tax assessment methods proves crucial for long-term budgeting.

Proactive homeowners should:

Can property taxes change after locking a mortgage rate?

Yes, property taxes fluctuate independently based on tax assessment methods and local budget needs.

How frequently do assessments occur?

Cycles vary from annual (Massachusetts) to quadrennial (Michigan) based on state laws.

Can I dispute my home's valuation?

All states provide appeal processes, with success rates around 40% according to the National Taxpayers Union.

Understanding the property taxes impact on mortgage payments helps buyers make informed decisions. By mastering local tax assessment methods and properly utilizing escrow accounts, homeowners can avoid budgetary surprises and maintain housing affordability throughout their loan term.

Disclaimer: This content about is for informational purposes only and does not constitute financial advice. Consult qualified professionals regarding your specific situation. The author and publisher disclaim liability for any actions taken based on this information.

Michael Carter

|

2025.08.06